About Us

At, Global Gain our mission is to provide our clients with the best solutions in wealth creation and wealth management. We are driven to provide clients with simple, unbiased and uncluttered professiaonal advice that adds value to their quality of life and results in actionable solutions. We are certified Wealth Manager, Mutual Fund and Insurance consultants recognized by the NSE National Stock Exchange, AMFI (Association of Mutual Fund of India). We offer comprehensive financial advisory services, having highly qualified and experienced team of financial advisors. We use our complete knowledge of insurance, tax laws, and mutual fund investments in order to suggest investment options to the clients, as per their long-term and short-term goals. Our core purpose is to provide fast track financial solutions & thereby make people enjoy a secured retirement life

Why Us

- Client Centric Approach:

- Rich Product Basket:

- Focus on Customer Satisfaction:

- Value Added Services:

- Right Experience & Skills:

- Driven by Passion:

All our offerings are designed keeping you in mind. Your long-term interests serve as the 'primary' influencing factor in our recommendations process.

We offer a single point access to multiple financial products with a holistic need-driven approach & not product centric approach.

We come equipped with the right attitude, people, processes and technology to ensure higher levels of satisfaction and service quality. In transactions, we work systematically to find & ensure quick resolution of any queries or complaints.

Our services ensure comfort, convenience, confidence and control to you in managing your wealth. You would enjoy being always updated of your investments, any time, anywhere.

We have over years of experience in financial advisory and products distribution space. Our experience, qualifications & skills enable us to understand you and your needs, and then offer you the right strategies & solutions to achieve your goals.

Serving clients is our passion and the reason why we are in the business. Nothing excites us more than helping our clients achieve their financial goals and dreams in life with our support.

Product Basket

MUTUAL FUND

We have all the mutual fund schemes on offer by virtually all the Asset Management Companies (AMCs) in the country. As a client, you can access any scheme with us, either in physical mode or even in a demat /stock-exchange mode with Trading Account services

Equity Funds

Debt Funds

Balanced Funds

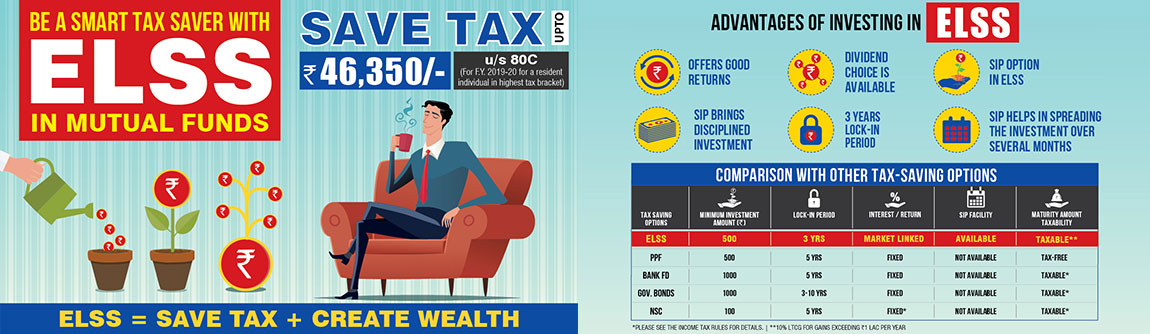

ELSS Funds

Small/Mid/Large Cap Funds

NFO

Mars

CAPITAL MARKET

We also offer our clients with NJ E-Wealth A/c services through one of the India's leading & highly reputed distribution houses. With the same you will have easy access to capital market products of direct equity stocks and Exchange Traded Funds (ETFs).

Open Demat & Trading Account

Debt Instruments

Preference Share

Equities

IPO

CORPORATE FDs AND BONDs

We also offer clients with diverse fixed income products, namely Non-Convertible Debentures (NCDs), Infrastructure and RBI Bonds, Company Deposits, etc. from some of the leading companies, institutions in India.

Capital Gain Bonds

Zero Coupon Bond

Sovereign Gold Bond

Non Convertible Debentures (NCD)

FD Issue by LIC Housing Finance Limited

FD Issue by ICICI Home Finance Co.Ltd.

HDFC TRUST FD

PORTFOLIO MANAGEMENT SERVICES (PMS)

We offer Portfolio Management Services (PMS) strategies with direct equity and mutual funds as the underlying products from the leading PMS providers in India. Some of our PMS strategies are exclusive in the market which can only be subscribed through us.

Aggresive

Defensive

Hybrid

HEALTH INSURANCE

Health insurance is a type of insurance coverage that pays for medical, surgical, and sometimes dental expenses incurred by the insured.

Individual Health Insurane

Family Health Insurance

Critical Illness Insurance

Senior Citizen Health Insurance

Top Up Health Insurance

Personal Accident Insurance

Group Health Insurance

LIFE INSURANCE

Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to named beneficiaries when the insured dies.

Term Insurance

Whole Life Policy

Endowment Policy

Money Back Policy

ULIP Plans

Annuity and Pension

MOTOR INSURANCE

Motor Insurance is a type of insurance policy which covers your vehicles from potential risks financially. Policyholder's car or two wheeler is provided financial security against damages arising out of accidents and other threats.

Commercial Vehicle Insurance

Two Wheeler Insurance

Car Insurance

TRAVEL INSURANCE

Travel insurance is an insurance product for covering unforeseen losses incurred while travelling. Basic policies generally only cover emergency medical expenses while overseas, while comprehensive policies typically include coverage for trip cancellation, lost luggage, flight delays, public liability, and other expenses.

Single Trip Travel Insurance Policy

Multi Trip Travel Insurance Policy

Group Travel Insurance Policy

Educational Travel Insurance Policy

DISTRIBUTE WIDE RANGE OF LOAN AND MORTGAGE

Get a quick and hassle-free loan with low interest rate

Loan Against Mutual Fund

Home Loan

Home Loan Transfer

Loan Against Property

Lap Balance Transfer

Business Loan

GET EXPERTS FINANCIAL ADVICE...

BECAUSE EXPERTS KNOWS THE BEST

Purchase of any financial products without consulting a financial planner is like

taking a medicine without doctor’s diagnosis.

We offer our expert advice for choosing the best investments

products which will lead to your financial freedom.

PLAN

Get customized advice across investments, goals, expenses, insurance, loans, estate planning, and taxes.

EXECUTE

Implement your customized advice by buying all the recommended financial products on one single platform.

MANAGE

Track your journey and review/rebalance your investments to make sure they are aligned with your goals.

ANALYSIS

Analysis of complex reports, topic or substance into smaller parts in order to gain a better understanding of it

BEST CLIENT SERVICES

We understand that merely having a rich product basket is not enough for our valued clients. What clients really need is a holistic platform for an entire family (or an organisation) to record, report & manage a comprehensive portfolio of holdings into multiple financial products. We are proud to offer the following highly acclaimed services to our clients.

CLIENT DESK

The Client Desk is a premium offering for our clients which provides entire wealth/portfolio information, covering every major financial /non-financial product, for an entire family or an organization. The access to the Client Desk is given through a highly secured, unique login-id and password to every client. The information inside the desk is updated on a daily basis and all transactions done through us are automatically updated so that clients need not make any entries. The Client Desk empowers you by keeping you updated & informed, anytime any where – through online access or through a mobile application.

MARS

One of the key challenges of managing a portfolio is to regularly monitor and adjust the portfolio on an ongoing basis as per your risk profile and in line with market movements. However, most advisors fail to do so as it involves making multiple transactions frequently in a time bound manner. We have a unique offering for our NJ E-Wealth A/c Clients called as 'MARS' that very effectively gives the answer to this problem. MARS is a technology powered tool which helps in managing asset allocation through periodic rebalancing of portfolio which involves research & logic driven scheme selection process. With two broad asset allocation offerings – Dynamic & Fixed, MARS is the answer to client worries on portfolio management.

NJ E-WEALTH A/C SERVICE

As a client of our NJ E-Wealth A/c service you can enjoy some big, tangible benefits. You can do hassle free, worry and error free transactions in a very easy, time and cost effective manner – any time, any where. We offer easy transaction facility and few very unique services for mutual fund transactions in our NJ E-Wealth A/c service, as given below. Fresh Purchase /Additional Purchase /Redemptions /Switch Transactions SIP and STP registration NFO – Purchase, Switch and SIP Registration Equity Stock SIP registration Equity IPOs and Debt IPOs Application Comprehensive reports What's more, we offer multiple modes of doing transactions as listed below... Mobile: Transact through application on your mobile Online Desk: Transact through online Trading Account Desk Phone: Call and transact through your phone Offline: Transact through physical instructions

FIXED INCOME

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year, and to repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. In order for a company to grow its business, it often must raise money – for example, to finance an acquisition; to buy equipment or land; or to invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the company. The company can give up equity by issuing stock or can promise to pay regular interest and repay the principal on the loan (bonds or bank loans). Fixed-income securities also trade differently than equities.

MUTUAL FUND

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. These investors may be retail or institutional in nature. Mutual funds have advantages and disadvantages compared to direct investing in individual securities. The primary advantages of mutual funds are that they provide economies of scale, a higher level of diversification, they provide liquidity, and they are managed by professional investors. On the negative side, investors in a mutual fund must pay various fees and expenses. Primary structures of mutual funds include open-end funds, unit investment trusts, and closed-end funds. Exchange-traded funds (ETFs) are open-end funds or unit investment trusts that trade on an exchange. Some close- ended funds also resemble exchange traded funds as they are traded on stock exchanges to improve their liquidity.

CAPITAL MARKET

A capital market is a financial market in which long-term debt or equity-backed securities are bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Capital markets are composed of primary and secondary markets. The most common capital markets are the stock market and the bond market. Capital markets seek to improve transactional efficiencies. These markets bring those who hold capital and those seeking capital together and provide a place where entities can exchange securities.

What Our Clients Say

Kavita Kumari

Post Office Goverment Employee

ABPM

I am a very happy investor. I get an immediate response from the experts on Global Gain whenever I raise a query.

Himanshu Kumar

Web Dev Creations

Ceo & Founder

I want to give the feedback 10/10. right now, I’m investing through ETmoney, grow and scripbox there are a lot of confusions so i will recommend to all Global gain because their advice with financial Education is help to achieve financial goal, thanks guys

Naresh Tanwar (Jaipur)

Property Consultant

Global gain is a great platform for investment. Interactive and clean User Interface. Features like creating your own portfolio are great. I started investing in MF due to global gain only. Very responsive Support team. Always available to help for any query

Deepak Jaiswal

Freelancer

Thanking you very much for your support for getting our policy quickly, I would appreciate your work Sent from Mail for Windows

Tarun Singhla

Entrepreneur

Thank you for your hard work. Your reports are close to the real scenario.

Contact Us

At, Global Gain our mission is to provide our clients with the best solutions in wealth creation and wealth management. We are driven to provide clients with simple, unbiased and uncluttered professiaonal advice that adds value to their quality of life and results in actionable solutions. We are certified Wealth Manager, Mutual Fund and Insurance consultants recognized by the NSE National Stock Exchange, AMFI (Association of Mutual Fund of India)

Head Office

A-62,Pul Prahladpur, New Delhi-110044

Branch Office

Plot No.31,Shri Sai Industrial Area Mohla Road, Sikri, Ballabgarh, Haryana-121004

Branch Office

B1-553,Rathpur Colony, Pinjore, Distric Panchkula , Haryana-134102

globalgain.in